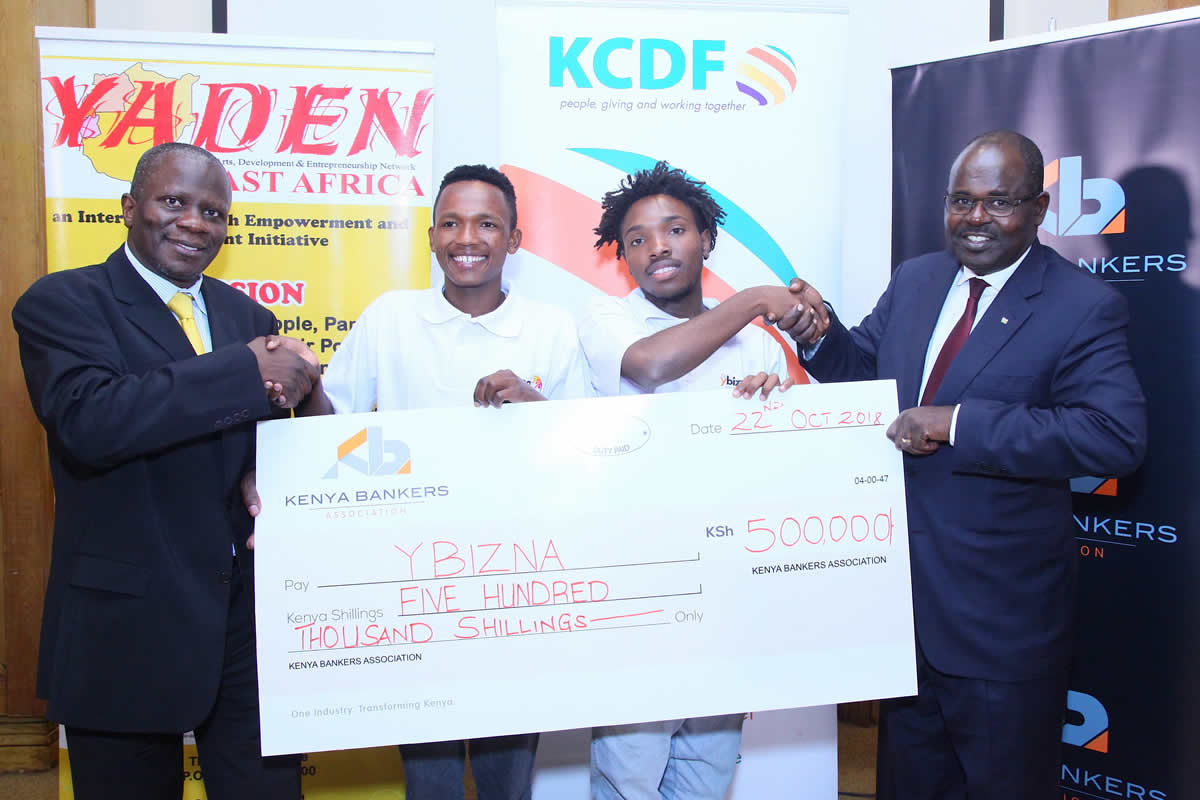

Nairobi 22nd October, 2018 – Young men drawn from Nairobi’s informal settlements have received funds to set up their own businesses after undergoing entrepreneurship training under a youth programme initiated by the banking industry in Kenya. The youth are among a pool of more than 300 aspiring entrepreneurs in Nairobi and Mombasa that successfully pitched for small business loans under the YBIZNA programme, supported by the Kenya Bankers Association.

The project, which seeks to enable vulnerable young people to empower themselves and transform their communities through enterprise, also aims to inculcate life skills in the youth through practical engagements designed to create new opportunities for themselves, their peers and their communities. Funds in the initiative are disbursed through a revolving fund, where the youth obtain interest-free loans to start new businesses or establish fresh enterprises. The Sh. 1 million project sets aside Sh. 500,000 for Nairobi and the same amount for Mombasa.

During a forum organized today to present the first batch of the fund’s beneficiaries, KBA Chief Executive Officer Dr. Habil Olaka commended the young men for opting to earn a living through business. Dr. Olaka said YBIZNA had met its objective of inspiring business acumen among the youth, facilitating access available social-economic opportunities in their neighborhoods.

“Through this programme, the banking industry has managed to engage young entrepreneurs in mentorship activities, promoting them as community pillars especially in ensuring peace and leadership,” he added, thanking all partners for supporting the program.

Targeting young men from the deprived informal settlements of Mathare, Huruma, Karibangi and Kisauni in Mombasa, the project aimed to address economic challenges as pathway to addressing crime, engagement of youth in electoral violence, besides making a contribution to promoting Corporate-Community partnerships.

The start-ups initiated by youths who have undergone the programme include: poultry farming, carpentry, phone repair, car wash, barber shops, pet dog rearing, and mat weaving, among others.

“The project has helped reduce crime, violence and improved the living standards of the young people in Mombasa and Nairobi, by training young men on management of small and micro-enterprise ventures (SMEs), financial literacy and provision of business mentorship,” noted KCDF.

The YBIZNA project which stands for Youth In Business project is implemented by Kenya Community Development Foundation (KCDF) in Mombasa and Nairobi slums, in partnership with DAYO(Mombasa) and YADEN(Nairobi).

About the Kenya Bankers Association:

KBA (www.kba.co.ke) was founded on 16th July 1962. Today, KBA is the financial sector’s leading advocacy group and banking industry umbrella body that represents total assets in excess of USD 40 billion. KBA has evolved and broadened its function to include advocacy on behalf of the banking industry, and championing financial sector development through strategic projects such as the launch of the industry’s first P2P digital payments platform PesaLink. In line with the Government’s policy on public-private partnerships, KBA and Central Bank of Kenya have implemented key projects such as modernization of the National Payments System through the Automated Clearing House, implementing the Real Time Gross Settlement System (RTGS), and the Kenya Credit Information Sharing Initiative. The KBA members are comprised of commercial banks and deposit taking microfinance banks. For more information, visit www.kba.co.ke.