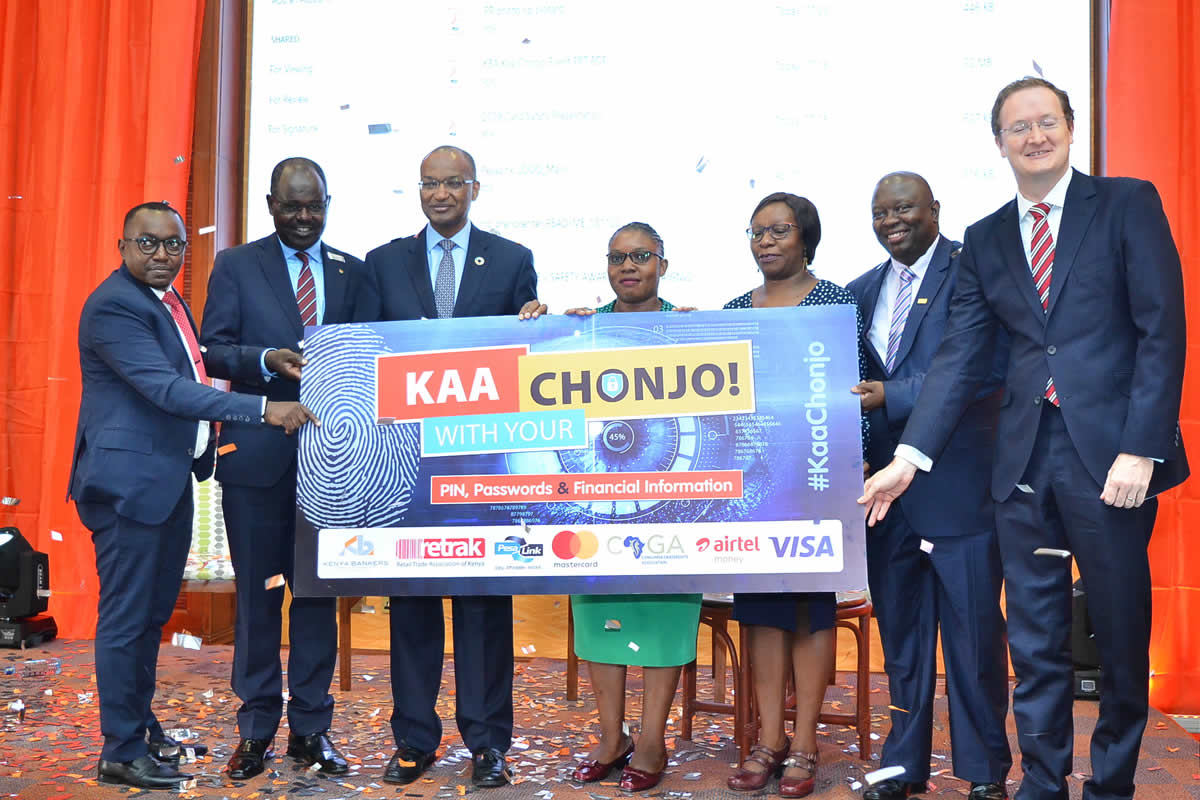

Nairobi Friday 3rd May, 2019 – Players in the financial and payment services industry have partnered to roll out a campaign aimed empowering consumers with knowledge to help protect themselves from fraud-related risks. Through the “Kaa Chonjo!” initiative banks, payments solution providers, consumer organizations, retailers and mobile network operators will seek to empower consumers with information on secure ways of using payment platforms and transaction channels.

Themed “Promoting Financial Technology Innovation and Security“, the public sensitization exercise has been organised by Kenya Bankers Association in collaboration with Visa, Retail Trade Association of Kenya (RETRAK), Mastercard, mobile operator Airtel, PesaLink, Consumer Grassroots Association (CGA), with support from KBA’s member banks’ networks across the country.

Speaking during the launch of the campaign, Central Bank Governor Dr. Patrick Njoroge encouraged institutuions to take steps to inform staff, vendors, partners and customers on emerging fraud trends and how to prevent them.

“Kaa Chonjo is a call for vigilance to all. In order to win the war on cyber security, all stakeholders must be ‘Kaa Chonjo’, be alert,” he said.

In his remarks, KBA Chief Executive Officer Dr. Habil Olaka, commended the partners for coming together to educate the public on ways of countering emergent security concerns. Dr. Olaka noted that continuous awareness initiatives were the best way of combating fraud.

“In view of the evolving nature of fraud, the banking industry believes that an empowered consumer is the most effective arsenal in addressing emerging security challenges such as cyber-security, data breaches, and social engineering,” he said, adding that the banking industry had over the past few years devoted more resources towards containing fraud through staff capacity building programmes and customer education programmes.

Dr. Olaka assured the public that their money is safe, noting that bank customers would not lose their money in light of the recent ATM heists. “It is important for bank customers to note that the losses incurred will not in any way affect their deposits. This is because the money is insured. At the same time, I would like to point out that the industry is working together to ensure such cases do not arise,” he said.

Financial and payment services have experienced a technological revolution over the past decade. The rapid integration of technology has been largely driven by the growing desire to satisfy customers and improve efficiency. However, fraud is among the challenges threatening safe transactions across channels.

Card-related fraud was previously a concern in the industry. KBA’s adoption of the Chip and PIN technology helped to alleviated the challenge after rolling out the EMV technology standard across the industry in partnership with Europay, MasterCard, and Visa.

“For people, merchants and governments to use electronic payments and enjoy their benefits, they need to trust them. That is why Visa invests in cutting-edge technology and collaborates with partners to ensure everyone is protected everytime they pay or are paid using our products, solutions, and network,” said Victor Ndlovu, Country Manager for Visa.

Mastercard Area Business Head East Africa, Middle East and Africa Adam Jones underscored the need for partnerships with merchants, issuers, digital players and others in this growing payments ecosystem to deliver consistency and security through industry standards across all payment scenarios – and new ones yet to come.

“Coupled with best-in-class services, consumers can finally experience the security, convenience and control long promised by the digital revolution. We are doing just that with Digital Commerce Solutions, our suite of offerings that delivers the best digital experience across all channels and devices,” he said, adding that Mastrcard’s mission is to make payments safe, simple and smart.

While mobile banking and payment services have gained popularity in the past decade, fraud trends seem to have shifted, with identity theft cases targeting mobile and online banking services users. Social engineering has also been identified among the new drivers of online and mobile fraud. In response to these challenges, mobile phone operators continue to develop strategies to ensure mobile money users transact safely.

“Airtel Kenya Limited is cognizant that the integrity of its network is paramount to providing the best possible service. Our network, which is regularly updated, is secure and robust. Furthermore, we are continuously guided by our license and regulations in running our operations in line with the law and local telecommunications standards,” said Prasanta Das Sarma, Managing Director, Airtel Kenya.

Acknowledging the important role of consumer education in mitigating fraud, Consumer Grassroots Association Executive Director Alice Kemunto said the multi-sector partnership will go a long way in protecting consumers in Kenya from fraud.

“CGA fully embraces this joint approach towards curbing the fraud. Greater responsibility, however, rests with the Central Bank of Kenya (CBK) to ensure that laws and regulations are reviewed and fully implemented to afford consumers secure financial and payment services,”she said.

Retail Trade Association CEO Wambui Mbarire observed that card payments remain an urban concept, saying more needs to be done to demystify “The ATM Card” to push its penetration off the ATM Machine. “Cash in urban areas competes very well with card payments. In Nairobi for example, it ranges at 40% and 35% respectively. The story is completely different in the rural areas where we range at 95% cash and 0.8% card, she said.

| Dr. Habil Olaka Kaa Chonjo Remarks |

Media Contact: KBA Director of Communications and Public Affairs, Nuru Mugambi Email: nmugambi@kba.co.ke Phone: 0717023318