Nairobi, 25th August 2017 – Kenya Bankers Association (KBA), the banking industry’s umbrella body and the financial sector’s lead advocacy group representing total assets in excess of Kshs. 3.7 trillion (USD 37 Billion), has announced that Mayfair Bank Ltd. has become its newest member, increasing its membership base to 47 commercial and micro finance banks.

Mayfair Bank, which was recently licenced by the Central Bank of Kenya (CBK), is set to target the Corporate Market Segment through its initial network of three branches. Two of the branches are situated in Nairobi and the third one in Mombasa.

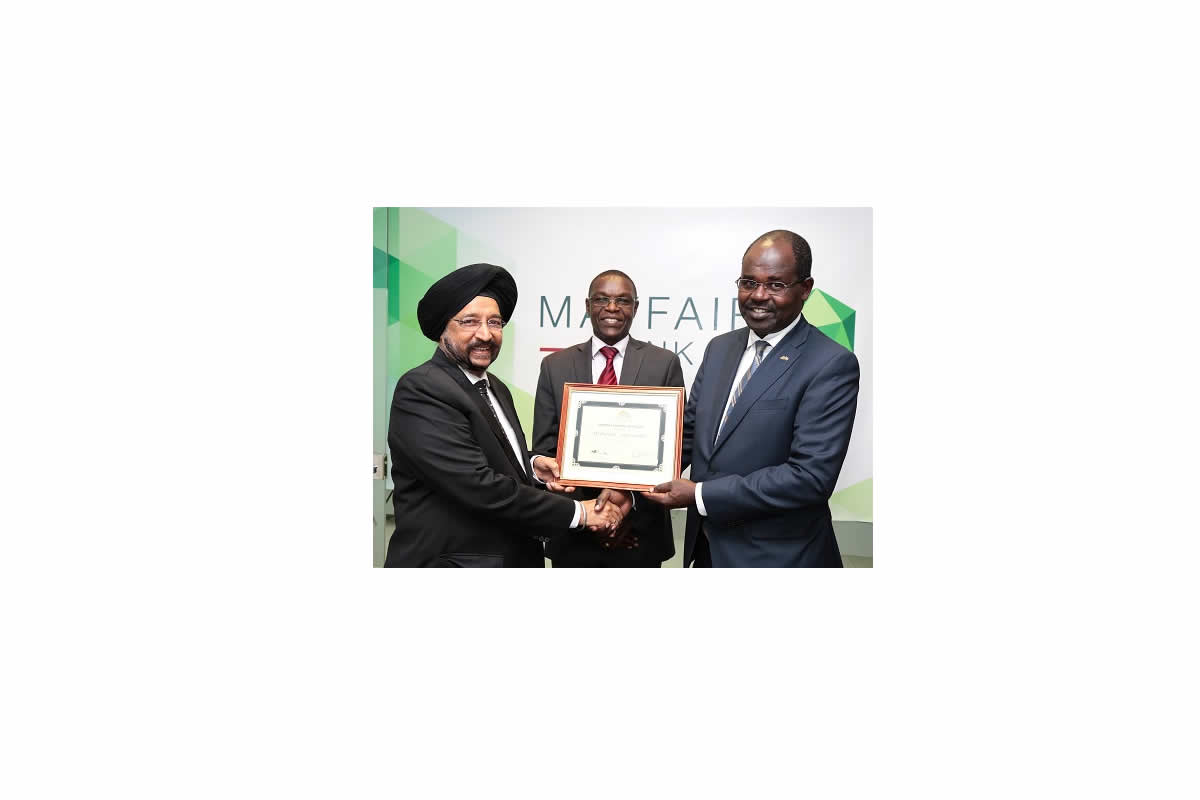

“We are glad to welcome Mayfair Bank on board as a member of KBA”, said KBA Chief Executive Officer, Mr. Habil Olaka. “Over the years, KBA has been at the forefront in supporting the industry to foster efficiency and innovation with the sole purpose of enhancing the service experience of all Kenyans. As our membership grows, we will remain steadfast in advancing the sector’s role in driving the country’s economic development,” he said.

Mr. Olaka added that the Association is celebrating its 55th Anniversary and reinforced the Association’s stewardship role over the years in steering the industry to adopt various key initiatives that have played a critical role in facilitating financial inclusion. Some of the notable initiatives include: modernising and enhancing security within the national payments system; as well as launching the Credit Information Sharing National Framework and more recently launching PesaLink, the country’s first real-time, bank-to-bank digital payments platform that is run by KBA’s subsidiary Integrated Payment Services Limited.

“KBA is an internationally-recognised industry organisation and we are pleased to be joining the Association,” said R.B. Singh, Mayfair’s Managing Director and Chief Executive Officer. “We look forward to collaborating with other industry players towards enhancing industry efficiency and innovation while increasing the role banks play in promoting sustainable economic development,” he said.

About Kenya Bankers Association

Founded on 16th July 1962, KBA has evolved and broadened its function to include advocacy on behalf of the banking industry, and championing financial sector development through strategic projects. KBA has undertaken major industrywide initiatives, including aligning standards on payments; promoting pricing transparency through the introduction of the Annual Percentage Rate framework (costofcredit.co.ke); and the modernization of the National Payments System through the Automated Clearing House, which KBA owns and operates. In line with the Government’s policy on public-private partnerships, the Association and CBK have implemented key milestone projects such as the Real Time Gross Settlement System (RTGS), and the Kenya Credit Information Sharing Initiative, which introduced the use of information collateral provided by credit reference bureaus to enhance credit access for borrowers.

Media Contacts:

Ms. Nuru Mugambi, Director of Communications and Public Affairs, Kenya Bankers Association

Phone: +254-20-2221704/2224014, Email: nmugambi@kba.co.ke